True values for your assets

Precious metals and raw materials in retrospect

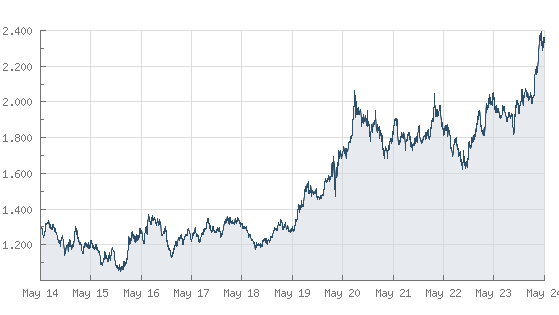

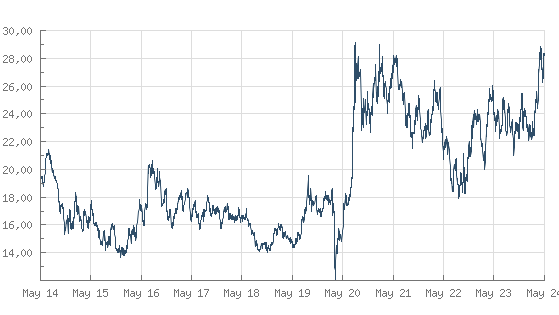

The development of prices for gold, silver and platinum over the last few years illustrates the opportunities for investment in precious metals.

The development of raw material prices is not entirely parallel to precious metals and can be quite different. Thus, the price of gold, for example, is not entirely dependent on development in industrial production, but more on the demand for jewelry and even more so on the risk of inflation and worries about inflation.

In contrast, the development of the prices for silver and platinum depend on industrial demand, and thus on economic development.

Considered in euro (which is the only criterion of interest for European investors), precious metals have experienced significant growth over the last few years. In 2013, gold, silver and platinum have strong value adjustments and therefore offer an interesting entry level. You will find the development courses of precious metals over the periods of 5, 10 and 15 years on the following pages.

It is always seductive to consider the previous values when attempting to define the ideal purchase and sell times, but that is merely consideration of the past. In the real world, this is almost impossible, since market development cannot be predicted. Working with our raw material concepts does not mean working with short-term trading products, but rather investments in precious metals oriented towards the long term.

Precious metal: GOLD

From the beginning, gold has been valued because of its color, luster and its rarity. Even today, gold hasn‘t surrendered any of its fascination. There is a particular demand for gold as an investment in the form of coins, ingots and jewelry. Because of its physical properties, gold also has a fixed place in the medical, electronics and IT industries. Viewed monetarily, physical gold is a liquid asset and therefore represents secure protection against inflation. Gold is not bound to a promise of payment to a bank or a government. Unlike money, it cannot simply be multiplied by a resolution from a central bank, as happened in a dramatic manner as part of the financial crisis. In contrast, developing gold is becoming more costly because the mineral deposits are limited. On the other hand, the demand is continuously increasing. For that reason as well, experts assume the price of gold will continue to increase over the long term.

Precious metal: SILVER

For centuries, silver has been used for preserving purchasing power and jewelry production. It relevance for industrial manufacturing processes, however, is increasing in importance.

One reason: silver has excellent properties for conducting heat and electricity. The existing electronics industry can no longer be ignored. One more reason: silver has anti-bacterial properties. This justifies its usage not just in the field of medical technology but also in other areas, such as water preparation and the development of impregnation technology.

With this in mind, industry experts are seeing clear signals for an increase in the price of silver. Silver has good prospects of becoming in the future what is has been considered more than once in the past: the gold of the little man.

Precious metal: PLATINUM

The general public often underestimates the importance of platinum.

The fact that platinum is significantly harder and mechanically more stable than gold explains its usage in manufacturing especially valuable jewelry, as a means of payment and for long-term investment.

The fact that platinum has noteworthy catalytic properties is at least as important. These properties make it attractive for industrial use to an increasing extent. Examples for this include catalytic converters in cars as well as in fuel cells. This also includes major industrial processes such as manufacturing nitric acid.

Precious metal: PALLADIUM

The chemical behavior of palladium is very similar to platinum. It is a commonly combined with gold in the jewelry industry to make white gold. This precious metal is also used for bullion coins, such as the Palladium Maple Leaf. Furthermore, palladium is used in the industry. It can also be found in catalytic exhaust systems for four-stroke engines.